Child Tax Credit 2024 Eligibility Requirements Worksheet – If you paid for childcare, you may also qualify for the child and dependent care credit. Depending on your circumstances, you can declare 20% to 35% of your childcare expenses. The maximum you can . People filing in 2024 Child Tax Credit offers support to as many as 48 million applying American adults who need an extra bit of help with raising their children so what are the new .

Child Tax Credit 2024 Eligibility Requirements Worksheet

Source : pluginamerica.org

Tax Calculator: Return & Refund Estimator for 2023 2024 | H&R Block®

Source : www.hrblock.com

2023 and 2024 Child Tax Credit: Top 7 Requirements TurboTax Tax

Source : turbotax.intuit.com

EV tax credits 2024: VERIFY Fact Sheet | verifythis.com

Source : www.verifythis.com

Publication 505 (2023), Tax Withholding and Estimated Tax

Source : www.irs.gov

IRS Child Tax Credit 2024: Credit Amount, Payment Schedule, Tax Return

Source : www.kvguruji.com

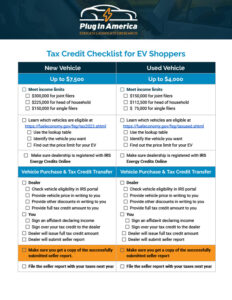

2024 Federal EV Tax Credit Information & FAQs Plug In America

Source : pluginamerica.org

Health Insurance Marketplace Calculator | KFF

Source : www.kff.org

Free Tax Calculators & Money Saving Tools 2023 2024 | TurboTax

Source : turbotax.intuit.com

Child Tax Credit 2023 2024: Requirements, How to Claim NerdWallet

Source : www.nerdwallet.com

Child Tax Credit 2024 Eligibility Requirements Worksheet 2024 Federal EV Tax Credit Information & FAQs Plug In America: Had or adopted a child in 2023? What new parents need to know about tax credits and deductions. Importantly, the enhanced Child Tax Credit went away in 2022. . To be eligible dollars in tax relief for New Mexicans, including: In New York, those who meet certain income and residency requirements can claim the Empire State child credit. .